UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant | [X] |

| Filed by a Party other than the Registrant | [ ] |

Check the appropriate box:

| Check the appropriate box: |

| [ ] | Preliminary Proxy Statement | |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6 (e)(2)) | |

| [X] | Definitive Proxy Statement | |

| [ ] | Definitive Additional Materials | |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

Monmouth Real Estate Investment Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [ | No fee required. |

| [ ] | Fee computed on table below per Exchange Act rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing |

| (1) | Amount previously paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: |

A Public REIT Since 1968

Monmouth Real Estate Investment Corporation Juniper Business Plaza, 3499 Route 9 North, Suite 3-D Freehold, New Jersey 07728

Notice of May 4:00 p.m. Eastern Time |

Notice is hereby given that the 20172018 Annual Meeting of Shareholders (the “2017“2018 Annual Meeting”) of Monmouth Real Estate Investment Corporation, a Maryland corporation (the(referred to as “we”, “our”, “us”, “Monmouth” or the “Company”) will be held on Thursday, May 18, 2017,17, 2018, at 4:00 p.m., Eastern Time, at Juniper Business Plaza, 3499 Route 9 North, Suite 3-D, Freehold, New Jersey, to consider and vote on the following matters, each as more fully described in the accompanying proxy statement:

Items of Business

| 1. | The election of four Class | |

| 2. | The ratification of the appointment of PKF O’Connor Davies, LLP as | |

| 3. | ||

| 4. | ||

| Such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. |

Record Date

TheMonmouth’s Board of Directors of the Company has fixed the close of business on March 14, 2017,2018, as the record date for the determination of shareholders entitled to notice of, and to vote at, the 20172018 Annual Meeting and any adjournments or postponements thereof.

EVEN IF YOU PLAN TO BE PRESENT IN PERSON, YOU SHOULD AUTHORIZE A PROXY TO VOTE YOUR SHARES PRIOR TO THE MEETING USING THE METHODS DETAILED ON PAGE 14PAGES 12-13 OF THIS PROXY STATEMENT.

| BY ORDER OF THE BOARD OF DIRECTORS | |

| |

| Michael D. Prashad | |

| In-House Counsel and Secretary |

March 31, 201730, 2018

YOUR VOTE IS IMPORTANT. PLEASE VOTE.

A Public REIT Since 1968

Monmouth Real Estate Investment Corporation Juniper Business Plaza, 3499 Route 9 North, Suite 3-D Freehold, New Jersey 07728

PROXY STATEMENT

May

SOLICITATION OF PROXIES |

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of Monmouth Real Estate Investment Corporation, a Maryland corporation, (the “Company”), of proxies to be voted at the 2017our 2018 Annual Meeting of Shareholders of the Company (the “Annual Meeting”) to be held on Thursday, May 18, 2017,17, 2018, at 4:00 p.m., Eastern Time, at theour offices of the Company at Juniper Business Plaza, 3499 Route 9 North, Suite 3-D, Freehold, New Jersey 07728, and at any adjournments or postponements thereof, forto consider and vote on the purposesmatters listed in the preceding Notice of Annual Meeting of Shareholders. This Proxy Statement and the accompanying Proxy Card are being distributed on or about March 31, 2017,30, 2018, to shareholders of record as of the close of business on March 14, 2017.2018. Unless the context requires otherwise, references in this Proxy Statement to “Monmouth”, “we”, “our”, “us” and the “Company” refer to Monmouth Real Estate Investment Corporation and its consolidated subsidiaries.

A copy of the Company’sour annual report, including financial statements, was mailed to all shareholders of record on or about February 14, 2017,January 31, 2018, and is available on the Company’sour website atwww.mreic.reit.www.mreic.reit.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON MAY 18, 201717, 2018

Under rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), you are able to obtain proxy materials via the Internet, instead of being mailed printed copies of those materials. This will expedite shareholders’ receipt of proxy materials, lower the cost of the annual meeting, and help conserve natural resources. Please visit the websitewww.proxyvote.comto view electronic versions of proxy materials and the Company’s 2016our 2017 Annual Report, and to request electronic delivery of future proxy materials. Have your Proxy Card or Notice of Internet Availability in hand when you access the website and follow the instructions. You will need your 12-digit Control Number, which is located on your Proxy Card or Notice of Internet Availability. Shareholders also may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

| 2 |

Proxy Statement Summary

This summary highlights the proposals to be voted upon, as well as financial performance, equity compensation plan, executive compensation, and corporate governance information described in more detail elsewhere in this Proxy Statement.

Annual Meeting Proposals

| Proposal | Recommendation of the Board | ||

| 1. Election of Directors | FOR each of the nominees | ||

| 2. Ratification of Independent Registered Public Accounting Firm | FOR | ||

| 3. | |||

Advisory Vote to Approve | FOR | ||

| 3 |

Financial Performance Highlights

Fiscal year ended September 30, 20162017 was another excellent year for Monmouth. Our industrial property portfolio performed exceptionally well, achieving a 99.6%99.3% occupancy rate and a 100%92% tenant retention rate. We believe that this past year represented one of the most productive years ever in our long history as a public REIT. ToWe highlight some of our many accomplishments the Company:achieved during fiscal 2017:

| ● | |||

| ● | |||

| ● | |||

| ● | |||

| ● | |||

| ● | |||

| ● | |||

| ● | |||

| ● | |||

| ● | |||

| ● | Growth in AFFO* per Diluted Share: Generated 9% year over year growth in Adjusted Funds From Operation (AFFO) per diluted share. | ||

Equity Compensation Plan Highlights

*NOI and AFFO are non-GAAP performance measures. See Financial Information for a discussion of our non-GAAP performance measures.

| 4 |

Shareholder Approval of Company’s Amended and Restated 2007 Incentive Award PlanStrategic Growth Highlights

On March 13, 2017, the Company’s Board of Directors approved an amendment and restatement to the Company’s 2007 Stock Option and Stock Award Plan, as amended (the “Original Plan”), conditioned upon shareholder approval. The Board recommends shareholders vote FOR the proposal to approve the Plan. The amendment and restatement of the Original Plan, which changes the name of the plan to the Amended and Restated 2007 Incentive Award Plan (the “Plan”), extends the term of the Original Plan for an additional ten years, adds 1.6 million shares of our Common Shares to the share reserve, expands the types of awards available for grant under the Plan and makes other improvements to the Original Plan. The Plan is intended to, among other things, promote the success and enhance the value of the Company by linking the individual interests of itsDirectors,Employees, and Consultants (as defined in the Plan) to those of Company shareholders and by providing such individuals with an incentive for outstanding performance to generate superior returns to Company shareholders.

The Plan includes provisions that are designed to protect our shareholders’ interests and to reflect corporate governance best practices, including:

| ● | |||

| ● | |||

| ● | |||

| ● | |||

| ● | |||

| ● | |||

| ● | At-The-Market Transaction: Raised an additional $36.4 million in gross proceeds from the issuance of | ||

| ● | Capital Raising through DRIP: Raised approximately $91.9 million through our Dividend Reinvestment and Stock Purchase Plan (DRIP). | ||

| ● | Debt Maturity:Extended our weighted average debt maturity from 9.6 years to 10.2 years. | ||

| ● | Cost of Debt: Reduced our weighted average interest rate on our fixed rate debt from 4.5% to 4.2%. | ||

| ● | Controlled General and Administrative Expense: Managed G&A costs to a very efficient level. G&A, as a percentage of gross revenue, decreased to 6% for fiscal year 2017 from 8% for fiscal year 2016. G&A, as a percentage of undepreciated assets, decreased to 48 basis points from 58 basis points for the fiscal years 2017 and 2016, respectively. | ||

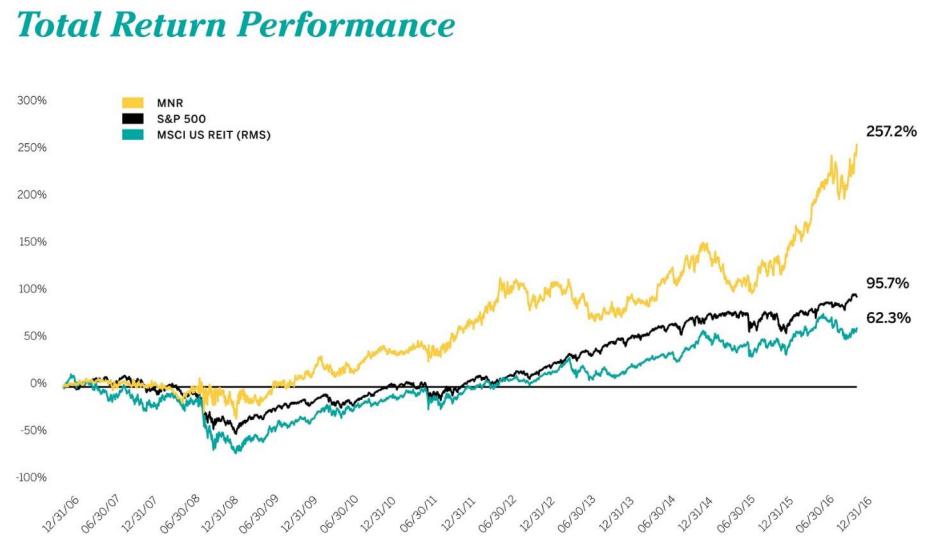

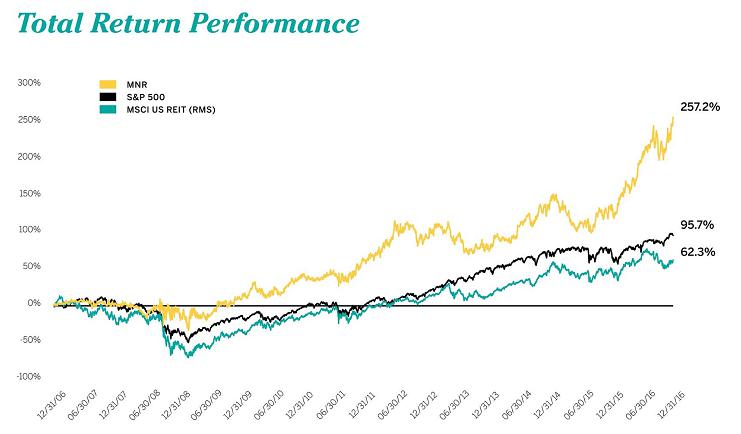

Since the approval of the Original Plan in 2007, the Company has generated a 10-year total shareholder return of approximately 257%, outperforming the S&P 500 and the MSCI US REIT Index by a wide margin.

| 5 |

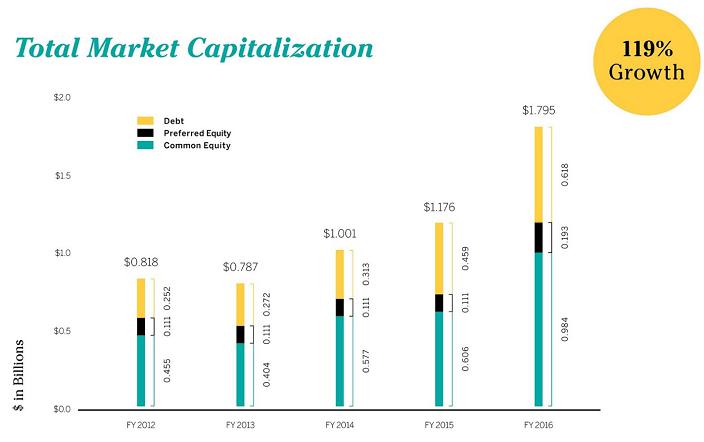

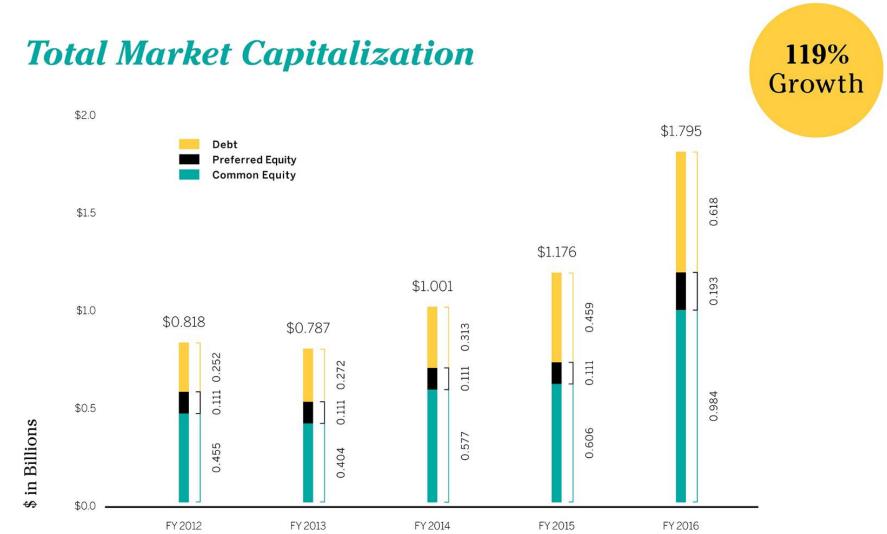

The Company’s equity market capitalization has also grown substantially, from approximately $201.6 million, as of September 30, 2007, to approximately $1 billion as of March 14, 2017. In addition, over the last 5-year period, the Company’s total market capitalization has grown approximately 119% from 2012 through 2016 fiscal yearend.

As of the close of business on March 14, 2017, the Company had 71,430,729 Common Shares outstanding and, when the Original Plan expired on March 26, 2017, 164,878 Common Shares remained available for grant under the Original Plan. The Plan, if approved by the Company’s shareholders, will provide an additional 1,600,000 shares, for a total of 1,764,878 Common Shares available for future grant of stock options, restricted stock, or other equity based awards, plus any shares subject to outstanding options that expire or are forfeited without being exercised. The additional Common Shares under the Plan represent approximately 2.24% of the Company’s total outstanding Common Shares as of March 14, 2017.

To further the success and growth of the Company attributable, in part, to the Original Plan, the Board recommends that the Company’s shareholders vote FOR the proposal to approve the Plan.

Say-on-Pay: Executive Compensation Highlights

At the Annual Meeting, the Company’sour shareholders will have the opportunity to consider and vote on an advisory say-on-pay proposal, to approve, on an advisory basis the compensation of our executive officers for the fiscal year ended September 30, 2016,2017, as described more fully in this Proxy Statement. Our executive compensation program is designed to be simple, effective, and link pay to performance, while reflecting the size, scope, and success of Monmouth’s business, as well as the responsibilities of our executive officers. While there are many factors that our shareholders considerare considered in evaluating executive compensation, ultimately, we believe that our shareholders strongly value economic performance.

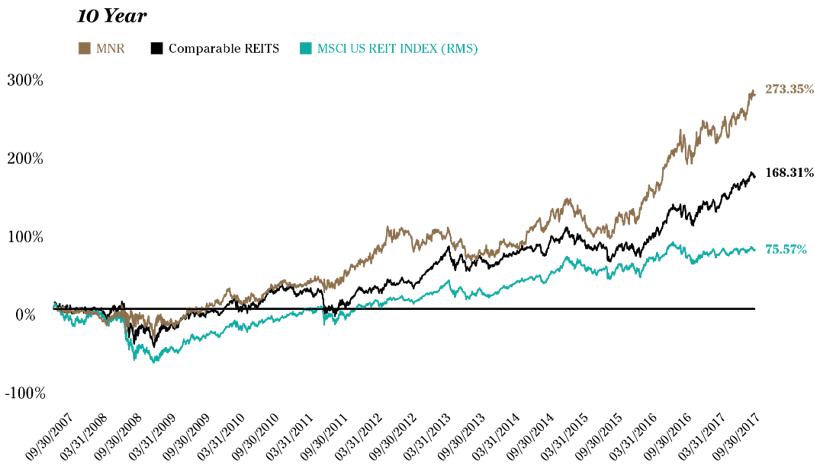

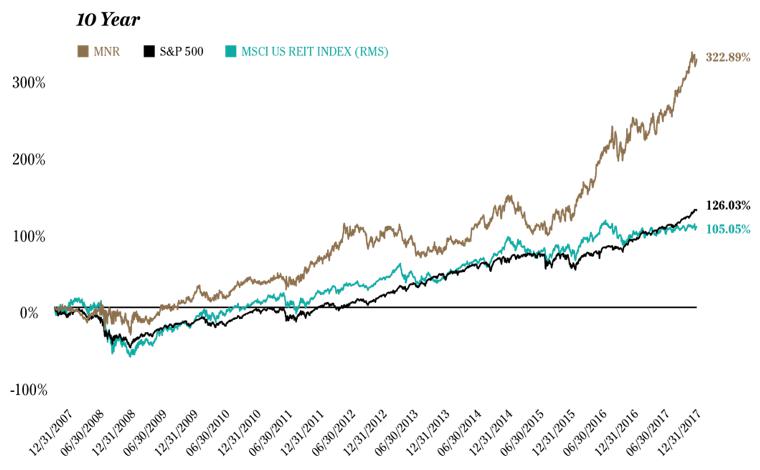

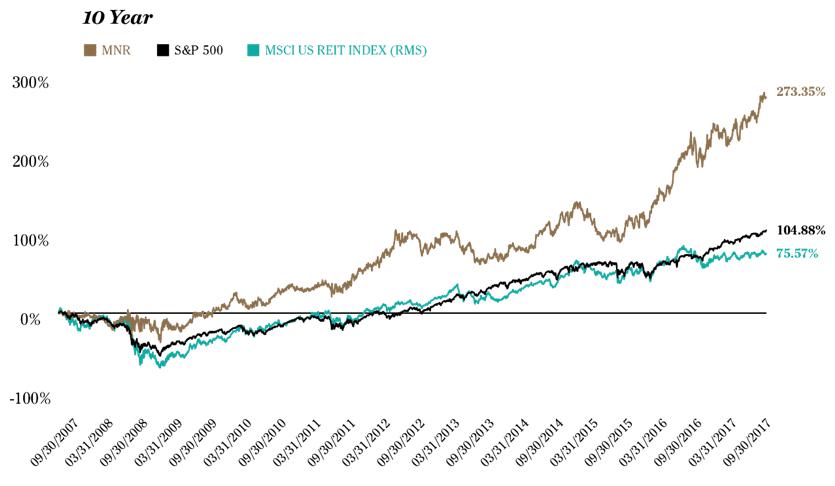

Pay for Performance: Total Shareholder Return

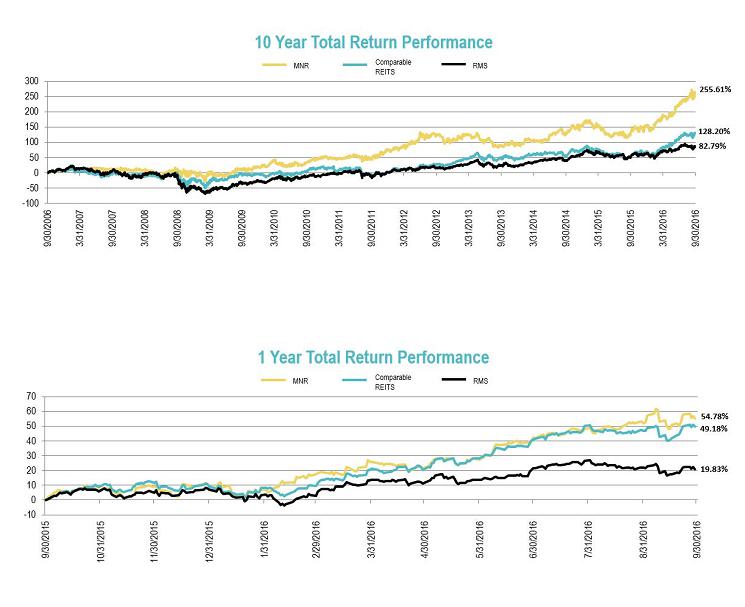

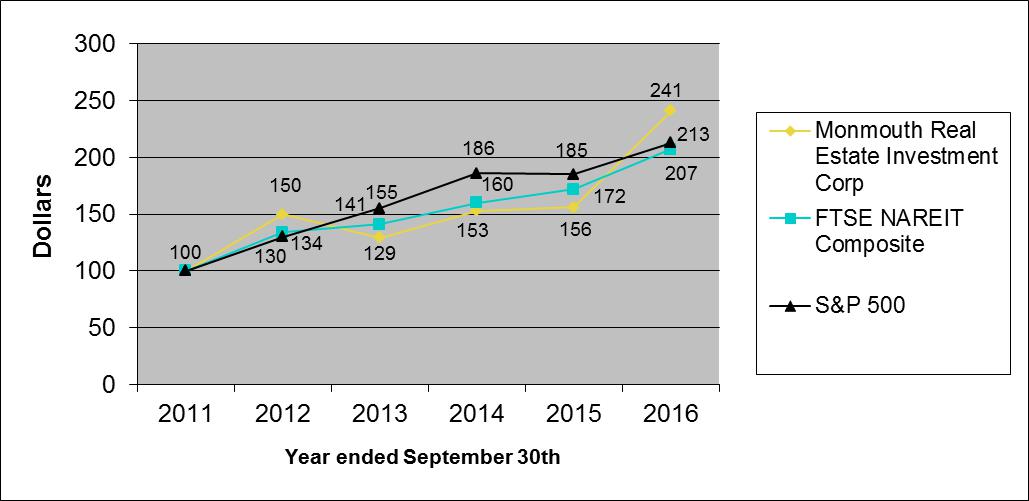

Since the time that Monmouth was founded in 1968, Monmouth haswe have delivered consistent and reliable returns for itsour shareholders. Over the last 10 years, Monmouth has outperformed the MSCI US REIT Index by a wide margin of over three times. Our total shareholder return (“TSR”) over the last 10 fiscal years was 255.6%273.4%. TSR includes both dividends reinvested and stock price appreciation. Historically, REIT dividends have accounted for approximately 65% of total shareholder return.TSR. We believe that it is essential that dividends be factored into evaluating a REIT’s economic performance. Our dividend has proven to be very reliable because our industrial properties are predominantly subject to long-term net leases to investment-grade tenants or their subsidiaries. As the result of our strong performance throughout fiscal 2017, on October 2, 2017, our Board of Directors approved a 6.3% increase in our quarterly common stock dividend, raising it to $0.17 per share from $0.16 per share, representing an annualized dividend rate of $0.68 per share. The 6.3% dividend increase marks our second dividend increase in three years, totaling 13% in dividend increases. We are proud to report that we have maintained or increased our dividend for 2526 consecutive years. We are one of the few REITs that maintained itsour dividend throughout the Global Financial Crisis. We are also one of the few REITs that is paying out a higher per share dividend today than prior to the Global Financial Crisis.

Comparable REITsREITs; Independent Compensation Consultant

In August 2017, our Compensation Committee engaged FPL Associates (FPL), a nationally recognized compensation consulting firm specializing in the REIT industry, to provide additional market-based compensation data and to advise on industry trends and best practices. In order to help our shareholders fairly evaluate the Company’sour executive compensation program in light of our relative economic performance, our management has identifiedFPL prepared for the Committee a peer group of REITs with similar equity markettotal capitalization, ranging between $750 million$1.4 billion and $2.5$4.0 billion (approximately 0.7x-2.0x Monmouth’s total capitalization), and/or REITs that operate within the industrial REIT sector and with whom we compete for talent. These REITs (the “Comparable REITs”) are:executive employees.

The peer group of comparable REITs (Comparable REITS) identified by FPL are as follows:

Agree Realty Corporation

EastGroup Properties*

Getty Realty Corporation

Hersha Hospitality Trust

LTC Properties, Inc.

Rexford Industrial Realty, Inc.*

STAG Industrial, Inc.*

Terreno Realty Corporation*

TIER REIT, Inc.

Urstadt Biddle Properties Inc.

*Denotes a peer that is in the Industrial sector

FPL compared our aggregate pay and performance to those of our peers over the prior three-year period. Based upon this analysis, FPL concluded that our aggregate pay ranks at the lowest end of the aggregate pay provided by our peers, and that our performance by Total Shareholder Return is at the highest end of performance of our peers.

Information about the Comparable REITs is presented here solely to assist the shareholders in evaluating the Company’sour performance and compensation programs in connection with the say-on-pay vote, and theSay-On-Pay vote. The Comparable REITs were not identified or used by our Compensation Committee in setting or evaluating the compensation of our named executive officers.Named Executive Officers for fiscal 2017. The Committee intends to use this data as one tool in considering compensation for our Named Executive Officers for compensation decisions beginning in fiscal 2018.

The following charts and tables* illustrate the Company’sour strong outperformance over the 1, 3, 5 and 10 year10-year periods as compared to the Comparable REITs and the MSCI US REIT Index. Total Return Performance is calculated based on the Company’s 2016our 2017 fiscal year ending September 30.

| Total Return Performance | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | 10 Year | |||||||||||||

| MNR | 54.78 | % | 87.33 | % | 141.48 | % | 255.61 | % | ||||||||

| Comparable REITs | 49.18 | % | 54.08 | % | 152.88 | % | 128.20 | % | ||||||||

| RMS | 19.83 | % | 48.58 | % | 108.10 | % | 82.79 | % | ||||||||

| Total Return Performance | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | 10 Year | |||||||||||||

| MNR | 18.69 | % | 87.27 | % | 90.99 | % | 273.35 | % | ||||||||

| Comparable REITs | 17.16 | % | 59.85 | % | 101.05 | % | 168.31 | % | ||||||||

| RMS | 0.54 | % | 31.90 | % | 57.98 | % | 75.57 | % | ||||||||

*Source: S&P Global Market Intelligence

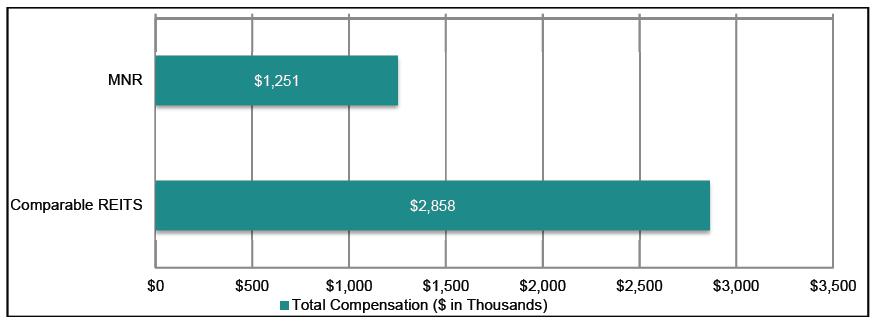

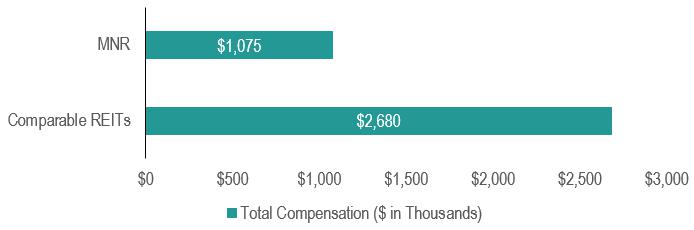

Getting More for Less

While Monmouth haswe have outperformed itsour peers and delivered exceptional results for itsour shareholders, itsour Chief Executive Officer’s total compensation for 20162017 was less than 50% of the average total compensation of chief executive officers of the Comparable REITs.

20162017 Monmouth CEO Total Compensation vs. Average CEO Total Compensation of Comparable REITs*

*The compensation data used for comparison purposes was obtained from the most recent filings for the Comparable REITs. For Comparable REITs that employed two chief executive officers, the Company used the compensation data of only one chief executive officer for the applicable Comparable REIT(s).

Total executive compensation of the Company also fell inwithin the lowest range (25th percentile) within the REIT industry based upon the 20162017 Compensation Survey published by NAREIT.

The Company continuesWe continue to efficiently manage itsour general and administrative expenses. General and administrative expenses, as a percentage of gross revenue, (which includes rental revenue, reimbursement revenue and dividend and interest income), remains low at onlyand decreased to 6% for fiscal year 2017 from 8% for fiscal years 2016 and 2015, as doesyear 2016. In addition, general and administrative expenses, as a percentage of undepreciated assets (which is the Company’sour total assets excluding accumulated depreciation), is at a very reasonableefficient 48 basis points for fiscal year 2017, which decreased from 58 basis points and 61 basis points for the fiscal years 2016 and 2015, respectively.year 2016.

In lightWe value the feedback provided by our shareholders. At the Annual Meeting of Shareholders held on May 18, 2017, approximately 92% of votes cast (excluding broker non-votes) were cast in favor of our Say-On-Pay proposal, which we believe affirms our shareholders’ support of our approach to our executive compensation program.

We have discussions with many of our shareholders on an ongoing basis regarding various corporate governance topics, including executive compensation, and we consider the above, as well as other information provided in this Proxy Statement,views of shareholders regarding the design and effectiveness of our executive compensation program. Our Board recommends the Company’sthat our shareholders vote FOR the Say-on-Pay proposal.Proposal (Proposal No. 3).

| 8 |

Corporate Governance Highlights

Publicly traded since 1968, Monmouth Real Estate Investment Corporation is one of the oldest publicly-traded equity REITs in the world. Our longevity is the direct result of being patient and conservative stewards of capital. TheOur Board’s decision-making process is guided by an appreciation for all that has been built in the past and a focus on continuing to create sustainable long-term value for the CompanyMonmouth and its shareholders for many years to come.

Our Board believes that effective corporate governance should include regular constructive discussions with our shareholders. We have a proactive engagement process that encourages feedback from our shareholders. This feedback helps shape our governance practices. Several practices in the chart below are the direct result of such feedback.

Some corporate governance highlights are as follows:

| Board Independence | ||

*Independent Board *Independent Board Committees: Our Audit, Compensation and Nominating/Corporate Governance Committees are composed entirely of independent directors. *Lead Independent Director: Our Board has identified a lead independent director. *Executive Sessions of Independent Directors: Our independent directors meet in executive session at least *Financial Expert: Four out of | ||

| Accessible, Diverse and Engaged Management Team | *Open Communication: We encourage open communication and strong working relationships among all of our directors, our Chairman and our CEO. *Access to management: Our directors have access to management and employees. *Diversity in management team: Our key functions are nearly 50% diverse based on gender, race or ethnicity. *Engagement with Community: Our Company supports our Named Executive Officers serving on non-profit boards and engaging in charitable activities in the greater community. | |

| Robust Officer and Director Stock Ownership | *CEO Stock Ownership: Our Chief Executive Officer is required to own Common Shares having a value equal to at least six times his base salary and he is well within compliance of these requirements, currently owning in excess of 2 times the ownership requirement as of fiscal yearend. *Named Executive Officer (NEO) Stock Ownership: Effective October 1, 2017, our Named Executive Officers are subject to Stock Ownership Guidelines of 2x their base salary. *Director Stock Ownership: Effective September 12, 2017, our Independent Directors are subject to Stock Ownership Guidelines of 3x their annual cash fee. *Substantial Insider | |

*NEO Stock | ||

| exercise price, tax or withholding). *Anti-Hedging | ||

| Accountability to Shareholders | ||

*Clawback Policy: Effective October 1, 2017, performance-based compensation to a Named Executive Officer may be recouped if the NEO engaged in fraud or willful misconduct contributing to the need for a material restatement of financial results. *No Poison | ||

*Annual Say-on-Pay: Non-binding votes on executive compensation will take place on an annual basis. *Annual Assessment of Compensation. We annually assess our compensation policies to |

| 9 |

FREQUENTLY ASKED QUESTIONS ABOUT THE ANNUAL MEETING

Why am I receiving this Proxy Statement?

You are receiving these materials because you owned shares of our Company’s common stock (sometimes referred to herein as “Common Shares”) as a “registered” shareholder or you held Common Shares in “street name” at the close of business on March 14, 2017,2018, the record date for the Annual Meeting, and that entitles you to vote at our Annual Meeting to be held at 4:00 p.m., local time, on Thursday, May 18, 2017,17, 2018, at theour offices of the Company at Juniper Business Plaza, 3499 Route 9 North, Suite 3-D, Freehold, New Jersey 07728, or any postponements or adjournments of such meeting, for the purposes set forth in the Notice of 20172018 Annual Meeting of Shareholders. This Proxy Statement contains information related to the solicitation of proxies for use at the Annual Meeting.

Who is soliciting my proxy?

This solicitation of proxies is made by and on behalf of our Board of Directors. We will pay the costs of soliciting proxies, which will consist primarily of the cost of printing, postage and handling. In addition to soliciting proxies by mail, our officers, directors and other employees, without additional compensation, may solicit proxies personally or by other appropriate means. It is anticipated that banks, brokers, fiduciaries, custodians and nominees will forward proxy soliciting materials to their principals, and that we will reimburse these persons’ out-of-pocket expenses.

The Company hasWe have also retained Okapi Partners LLC (“Okapi”), a proxy solicitation firm, to assist in the distribution of proxy materials and the solicitation of proxies from brokerage firms, banks, broker-dealers, and other similar organizations representing beneficial owners of sharesCommon Shares for the Annual Meeting. We have agreed to pay Okapi a fee of approximately $25,000,$20,000, plus out-of-pocket expenses. You may contact Okapi at (877)-629-6355.

What is the difference between a “registered” shareholder and a shareholder holding shares in “street name?”

If your Common Shares are registered directly in your name with American Stock Transfer & Trust Company, LLC (“AST”), our transfer agent, you are a “registered” shareholder. If you own Common Shares through a broker, bank, trust or other nominee rather than in your own name, you are the beneficial owner of the Common Shares, but considered to be holding the Common Shares in “street name.”

Who can attend the Annual Meeting?

All of our common shareholders of record as of the close of business on March 14, 2017,2018, the record date for the Annual Meeting, or individuals holding their duly authorized proxies, may attend the Annual Meeting. You should be prepared to present photo identification for admittance. Appointing a proxy in response to this solicitation will not affect a shareholder’s right to attend the Annual Meeting and to vote in person. Please note that if you hold your Common Shares in “street name” (that is, through a broker, bank or other nominee), you will need to bring a copy of a brokerage statement reflecting your stock ownership as of the close of business on March 14, 2017,2018, the record date for the Annual Meeting, to gain admittance to the Annual Meeting.

Who may vote?

You may vote if you owned Common Shares at the close of business on March 14, 2017,2018, which is the record date for the Annual Meeting. You are entitled to cast one vote for as many individuals as there are directors to be elected at the Annual Meeting and to cast one vote on each other matter presented at the Annual Meeting for each Common Share that you owned as of the record date. Cumulative voting is not permitted in the election of directors.

| 10 |

What is a quorum for the Annual Meeting?

As of the close of business on March 14, 2017,2018, we had 71,430,72978,252,225 Common Shares outstanding. In order to conduct a meeting, shareholders entitled to cast a majority of the votes entitled to be cast at the Annual Meeting must be present in person or by proxy. No business may be conducted at the Annual Meeting if a quorum is not present. If you submit a properly executed Proxy Card or authorize a proxy by telephone or via the Internet, you will be considered part of the quorum. Abstentions and broker “non-votes” will be counted as present and entitled to vote for purposes of determining a quorum. A broker “non-vote” results when a bank, broker or other nominee who holds shares for another person has not received voting instructions from the owner of the shares and, under the applicable rules, does not have discretionary authority to vote on a matter.

What am I voting on?

At the Annual Meeting, you may consider and vote on:

| 1. | The election of four Class | |

| 2. | A proposal to ratify the appointment of PKF O’Connor Davies, LLP as our independent registered public accounting firm for the fiscal year ending September 30, | |

| 3. | ||

| A proposal to approve the following resolution (the “Say-on-Pay” proposal): | ||

| RESOLVED, that the shareholders approve, on an advisory basis, the compensation of the Corporation’s Named Executive Officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation, Discussion and Analysis, the compensation tables and narrative discussion in the Proxy Statement; | ||

| Any other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

We are not aware of any other business, other than procedural matters relating to the Annual Meeting or the proposals listed above, that may properly be brought before the Annual Meeting. Once the business of the Annual Meeting is concluded, members of management will respond to questions raised by shareholders, as time permits.

What are the Board’s recommendations?

The Board recommends a vote:

| ● | FOR the election of each nominee named in this Proxy Statement for election as a Class | |

| ● | FOR the ratification of the appointment of PKF O’Connor Davies, LLP as our independent registered public accounting firm for the fiscal year ending September 30, | |

| ● | FOR the approval of the |

Unless you give other instructions on your Proxy Card, the persons named as proxy holders on the Proxy Card will vote in accordance with the recommendations of the Board.

| 11 |

How many votes are needed to approve each of the proposals assuming that a quorum is present at the Annual Meeting?

Proposal 1: Election of Directors: The election of a director nominee must be approved by a plurality of the votes cast in the election of directors.

Proposal 2: Approval of the ratification of the appointment of PKF O’Connor Davies, LLP as our independent registered public accounting firm for the fiscal year ending September 30, 20172018 requires the affirmative vote of a majority of the votes cast on the proposal.

Proposal 3: Approval of the Amended and Restated 2007 Incentive Award Plan requires the affirmative vote of a majority of the votes cast on the proposal.

Proposal 4: Approval of the Say-on-Pay proposal requires the affirmative vote of a majority of the votes cast on the proposal.

Proposal 5: The frequency of “one year”, “two years” or “three years” that receives the greatest number of votes with respect to the frequency of future Say-on-Pay proposals will indicate the shareholders’ preference.

If you are a shareholder of record as of the record date for the Annual Meeting and you authorize a proxy (whether by Internet, telephone or mail) without specifying voting instructions on any matter to be considered at this Annual Meeting, the proxy holders will vote your shares according to the Board’s recommendation on that matter and in their discretion on any other matter that may properly come before the Annual Meeting.

If you are a shareholder of record as of the record date for the Annual Meeting and you fail to authorize a proxy or attend the meeting and vote in person, assuming that a quorum is present at the Annual Meeting, it will have no effect on the result of the vote on any of the matters to be considered at the Annual Meeting.

If you hold your shares through a broker, bank or other nominee, under the rules of the New York Stock Exchange (“NYSE”), your broker or other nominee may not vote with respect to certain proposals unless you have provided voting instructions with respect to that proposal. As noted above, this is referred to as a broker “non-vote.” A broker non-vote is not considered a vote cast on a proposal and broker non-votes will have no effect on the vote on any of the matters to be considered at the Annual Meeting. If you hold your shares in a brokerage account, then, under NYSE rules and Maryland law, your broker is entitled to vote your shares on Proposal No. 2 (Ratification of Independent Registered Public Accounting Firm) if no instructions are received from you, but your broker isnot entitled to vote on Proposal No. 1 (Election of Directors), or Proposal No. 3 (Approval of Equity Compensation Plan), Proposal No. 4 (Say-on-Pay), and Proposal No. 5 (Say-on-Frequency), without specific instructions from you. If you instruct your proxy or broker to “abstain” on any matter, it will have no effect on the approval of any of the matters to be considered at the Annual Meeting.

How do I vote?

If you plan to attend the Annual Meeting and wish to vote in person, we will give you a ballot at the Annual Meeting. However, if your Common Shares are held in the name of your broker, bank or other nominee, and you want to vote in person, you will need to obtain a legal proxy from the institution that holds your Common Shares.

If your Common Shares are held of record in your name, there are three ways for you to authorize a proxy:

| ● | By Telephone or on the Internet – You can authorize a proxy by calling the toll-free telephone number on your Proxy Card or Notice of Internet Availability. Please have your Proxy Card or Notice of Internet Availability in hand when you call. Easy-to-follow voice prompts allow you to authorize a proxy to vote your shares and confirm that your instructions have been properly recorded. The website for Internet voting is www.proxyvote.com. Please have your Proxy Card or Notice of Internet Availability handy when you go online. As with telephone voting, you can confirm that your instructions have been properly recorded. Telephone and Internet voting facilities for shareholders of record will be available 24 hours a day, and will close at 11:59 p.m., Eastern Time, on May |

| 12 |

| ● | By Mail – If you received your Annual Meeting materials by mail, you may complete, sign and date the Proxy Card and return it in the prepaid envelope. If you are a shareholder of record and you return your signed Proxy Card but do not indicate your voting preferences, the persons named in the Proxy Card will vote the shares represented by that proxy as recommended by the Board of Directors on each matter listed in this Proxy Statement and in their discretion on any other matter properly brought before the Annual Meeting. | |

| ● | In Person at the Annual Meeting – All shareholders of record may vote in person at the Annual Meeting. You may also be represented by another person at the Annual Meeting by executing a proper proxy designating that person. Even if you plan to attend the Annual Meeting, we request that you authorize a proxy in advance as described above so that your vote will be counted if you later decide not to attend the Annual Meeting. |

If you mail us your properly completed and signed Proxy Card or authorize a proxy to vote your shares by telephone or Internet, your votes will be cast according to the choices that you specify.specify and the persons named as your proxies will vote in their discretion on any other matters properly brought before the Annual Meeting. Unless you indicate otherwise on your Proxy Card, the persons named as your proxies will cast your votes: FOR all of the nominees for election as directors named in this Proxy Statement; FOR the ratification of the appointment of PKF O’Connor Davies, LLP as our independent registered public accounting firm; FOR the approval of the Amended and Restated 2007 Incentive Award Plan; FOR the approval of the Say-on-Pay proposal; FOR ONE-YEAR as the frequency of future Say-on-Pay proposals, and in their discretion on any additional matters properly brought before the Annual Meeting.

If your Common Shares are held in the name of your broker, bank or other nominee, you should receive separate instructions from the holder of your Common Shares describing how to provide voting instructions.

Can I revoke my proxy?

Yes, if your Common Shares are held in your name, you can revoke your proxy by:

| ● | Filing written notice of revocation before our Annual Meeting with our Secretary at the address shown on the front of this Proxy Statement; | |

| ● | Signing a proxy bearing a later date; or | |

| ● | Voting in person at the Annual Meeting. |

Attendance at the Annual Meeting will not, by itself, revoke a properly executed proxy. If your Common Shares are held in the name of your broker, bank or other nominee, please follow the voting instructions provided by the holder of your Common Shares regarding how to revoke your instructions.

| 13 |

PROPOSAL 1

ELECTION OF DIRECTORS

The Company’sOur charter and bylaws provide for a classified board of directors comprised of Class I, II, and III directors. Four Class IIIII directors are up for election at the Annual Meeting, to serve until the Company’sour annual meeting of shareholders in 20202021 and until their successors are duly elected and qualify. The four nominees for election as Class IIIII directors are set forth below. Unless instructed otherwise, the proxy holders will vote all proxies received by them for the nominees listed below or, if any such nominee is unwilling or unable to serve, for any other nominee designated by the Company’sour Board of Directors. As of the date of this Proxy Statement, the Company’sour Board of Directors is not aware of any other individual who may properly be nominated for election as a Class IIIII director at the Annual Meeting or of any nominee who is unable or unwilling to serve as director, if elected. The nominees listed below are currently each serving as a director of the Company and each has consented, if elected as a director, to serve until his term expires.

The Company’sOur Board of Directors currently consists of eleventwelve directors, four of whom have terms expiring at the Annual Meeting and when their successors are duly elected and qualify.

[Information Regarding Director Nominees are on the Following Page]

| 14 |

INFORMATION REGARDING DIRECTOR NOMINEES

The following information concerning the principal occupation, other affiliations and business experience of each of the four Class IIIII Director nominees during the last five years has been furnished to the Companyus by such nominee:

| Nominee | Age | Present Position with the Company; Business Experience During Past Five Years; Other Directorships | Director Since | |||

| Brian H. Haimm | 47 | Independent Director.Chief Financial Officer and Chief Operating Officer (2006 to present) of Ascend Capital Group International, LLC, a private equity firm. Mr. Haimm’s extensive experience in accounting, finance and the real estate industry is the primary reason, among others, why Mr. Haimm was selected to serve on our Board and has been nominated for re-election as a Class II Director. | 2013 | |||

| Neal Herstik | 58 | Independent Director.Attorney at Law, Gross, Truss & Herstik, PC (1997 to present). Mr. Herstik’s extensive legal experience and experience in the real estate industry is the primary reason, among others, why Mr. Herstik was selected to serve on our Board and has been nominated for re-election as a Class II Director. | 2004 | |||

| Matthew I. Hirsch | 57 | Independent Director.Attorney at Law (1985 to present), Law Office of Matthew I. Hirsch; Adjunct Professor of Law, Delaware Law School of Widener University (1993 to present).

For UMH Properties, Inc. (“UMH”), a related company, Director (2013 to present).

Mr. Hirsch’s experience with real estate transactions, legal issues relating to real estate and the real estate industry is the primary reason, among others, why Mr. Hirsch was selected to serve on our Board and has been nominated for re-election as a Class II Director. | 2000 | |||

| Stephen B. Wolgin | 62 | Lead Independent Director.Managing Director of U.S. Real Estate Advisors, Inc. (2000 to present), a real estate advisory services group based in New Jersey. Partner with the Logan Asset Backed Fund, LP (2007 to present). Prior affiliations with J.P. Morgan, Odyssey Associates, The Prudential Realty Group, Standard & Poor’s Corporation, and Grubb and Ellis.

For UMH Properties, Inc., a related company, Director (2007 to present).

Mr. Wolgin’s extensive experience as a real estate and finance consultant and experience in the real estate industry are the primary reasons, among others, why Mr. Wolgin was selected to serve on our Board and has been nominated for re-election as a Class II Director. | 2003 |

| Nominee | Age | Present Position with the Company; Business Experience During Past Five Years; Other Directorships | Director Since | |||

| Catherine B. Elflein | 57 | Independent Director. Certified Public Accountant. Senior Director – Risk Management (2006 to present) at Celgene Corporation, a biopharmaceutical company; Controller of Captive Insurance Companies (2004 to 2006) and Director – Treasury Operations (1998 to 2004) at Celanese Corporation. Ms. Elflein’s extensive experience in accounting, finance and risk management is the primary reason, among others, why Ms. Elflein was selected to serve on our Board.

| 2007 | |||

| Eugene W. Landy | 84 | Founder and Chairman of the Board (1968 to present), President and Chief Executive Officer (1968 to April 2013) and Executive Director. Attorney at Law. Chairman of the Board (1995 to present).

For UMH Properties, Inc., a related company, Founder and Chairman of the Board, Director (1969 to present) and President (1969 to 1995).

As our Founder and Chairman, Mr. Landy’s unparalleled experience in real estate investing is the primary reason, among others, why Mr. Landy was selected to serve on our Board. | 1968

| |||

| Michael P. Landy | 56 | President and Chief Executive Officer (April 2013 to present) and Executive Director. Chief Operating Officer (2011 to April 2013), Executive Vice President (2009 to 2010), Executive Vice President-Investments (2006 to 2009), and Vice President-Investments (2001 to 2006). Member of New York University’s REIT Center Board of Advisors (2013 to present).

For UMH Properties, Inc., a related company, Director (2011 to present) and Executive Vice President (2010 to 2012).

Mr. Landy’s role as our President and Chief Executive Officer and extensive experience in real estate finance, investment, capital markets and operations management are the primary reasons, among others, why Mr. Landy was selected to serve on our Board.

| 2007 | |||

| Samuel A. Landy | 57 | Non-Executive Non-Independent Director. Attorney at Law.

For UMH Properties, Inc., a related company, President and Chief Executive Officer (1995 to present), Vice President (1991 to 1995) and Director (1992 to present).

Mr. Landy’s extensive experience in real estate investment and REIT leadership is the primary reason, among others, why Mr. Landy was selected to serve on our Board.

| 1989 |

Vote Required:

At the Annual Meeting, theour shareholders of the Company will be requested to elect four Class IIIII Directors. A plurality of the votes cast in person or by proxy at the Annual Meeting, assuming a quorum is present, is required to elect a nominee.

Board Recommendation:

THE COMPANY’SOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS YOU VOTE “FOR” THE ELECTION OF THE FOUR NOMINEES NAMED ABOVE

INFORMATION CONCERNING CONTINUING DIRECTORS AND EXECUTIVE OFFICERS

Class III Directors with Terms Expiring in 2018

| Director | Age | Present Position with the Company; Business Experience During Past Five Years; Other Directorships | Director Since | |||

| Catherine B. Elflein | 56 | Independent Director.Certified Public Accountant. Senior Director – Risk Management (2006 to present) at Celgene Corporation, a biopharmaceutical company; Controller of Captive Insurance Companies (2004 to 2006) and Director – Treasury Operations (1998 to 2004) at Celanese Corporation. Ms. Elflein’s extensive experience in accounting, finance and risk management is the primary reason, among others, why Ms. Elflein was selected to serve on our Board. | 2007 | |||

| Eugene W. Landy | 83 | Founder and Chairman of the Board (1968 to present), President and Chief Executive Officer (1968 to April 2013) and Director.Attorney at Law. Partner of the Law Firm of Landy & Landy; Chairman of the Board (1995 to present).

For UMH Properties, Inc., a related company, Founder and Chairman of the Board, Director (1969 to present) and President (1969 to 1995).

As our Founder and Chairman, Mr. Landy’s unparalleled experience in real estate investing is the primary reason, among others, why Mr. Landy was selected to serve on our Board. | 1968 | |||

| Michael P. Landy | 55 | President and Chief Executive Officer (April 2013 to present) and Director.Chief Operating Officer (2011 to April 2013), Executive Vice President (2009 to 2010), Executive Vice President-Investments (2006 to 2009), and Vice President-Investments (2001 to 2006). Member of New York University’s REIT Center Board of Advisors (2013 to present).

For UMH Properties, Inc., a related company, Director (2011 to present) and Executive Vice President (2010 to 2012).

Mr. Landy’s role as our President and Chief Executive Officer and extensive experience in real estate finance, investment, capital markets and operations management are the primary reasons, among others, why Mr. Landy was selected to serve on our Board. | 2007 | |||

| Samuel A. Landy | 56 | Director. Attorney at Law (1985 to present), Partner of the Law Firm of Landy & Landy.

For UMH Properties, Inc., a related company, President and Chief Executive Officer (1995 to present), Vice President (1991 to 1995) and Director (1992 to present).

Mr. Landy’s extensive experience in real estate investment and REIT leadership is the primary reason, among others, why Mr. Landy was selected to serve on our Board. | 1989 |

Class I Directors with Terms Expiring in 2019

| Director | Age | Present Position with the Company; Business Experience During Past Five Years; Other Directorships | Director Since | |||

| Anna T. Chew | 58 | Director.Interim Chief Financial Officer (March 2012 to July 2012). Chief Financial Officer (1991 to 2010).

For UMH Properties, Inc., a related company, Vice President and Chief Financial Officer (1995 to present) and Director (1995 to present).

Ms. Chew is a Certified Public Accountant. Ms. Chew’s extensive public accounting, finance and real estate industry experience is the primary reason, among others, why Ms. Chew was selected to serve on our Board. | 2007 | |||

| Daniel D. Cronheim | 62 | Director.Attorney at Law (1979 to present). Certified Property Manager (2010 to present). President (2000 to present) of David Cronheim Mortgage Company, a privately-owned real estate investment bank. Executive Vice President (1997 to present) of Cronheim Management Services, Inc., a real estate management firm. Executive Vice President (1989 to present) and General Counsel (1983 to present) of David Cronheim Company, a real estate brokerage firm. Executive Committee (2012 to present), Secretary-Treasurer (2013 to 2015), Vice-President (2015 to 2016) and President (2016 to present) of The Institute of Real Estate Management (IREM) Chapter One (New Jersey). Member and instructor (2014 to present) of the New Jersey State Bar Association Land Use Committee. Member (1986 to 1993) and Chairman (1994 to present) of Borough of Watchung Zoning Board. Mr. Cronheim’s extensive experience in real estate management and the mortgage industry is the primary reason, among others, why Mr. Cronheim was selected to serve on our Board. | 1989 | |||

| Scott L. Robinson | 46 | Independent Director.Managing Director, Oberon Securities (2013 to Present); Clinical Professor of Finance and Director of The REIT Center at New York University (2008 to Present); Managing Partner, Cadence Capital Group (2009 to 2013); Vice President, Citigroup (2006 to 2008); Senior REIT and CMBS analyst (1998 to 2006), Standard & Poor’s. Mr. Robinson’s extensive experience in real estate finance and investment is the primary reason, among others, why Mr. Robinson was selected to serve on our Board. | 2005 |

| Nominee | Age | Present Position with the Company; Business Experience During Past Five Years; Other Directorships | Director Since | |||

| Daniel D. Cronheim | 63 | Director. Attorney at Law (1979 to present).Certified Property Manager (2010 to present). President (2000 to present) of David Cronheim Mortgage Company, a privately-owned real estate investment bank. Executive Vice President (1997 to present) of Cronheim Management Services, Inc., a real estate management firm. Executive Vice President (1989 to present) and General Counsel (1983 to present) of David Cronheim Company, a real estate brokerage firm. Executive Committee (2012 to present), Secretary-Treasurer (2013 to 2015), Vice-President (2015 to 2016) and President (2016 to present) of The Institute of Real Estate Management (IREM) Chapter One (New Jersey). Member and instructor (2014 to present) of the New Jersey State Bar Association Land Use Committee. Member (1986 to 1993) and Chairman (1994 to present) of Borough of Watchung Zoning Board. Mr. Cronheim’s extensive experience in real estate management and the mortgage industry is the primary reason, among others, why Mr. Cronheim was selected to serve on our Board.

| 1989 | |||

Kevin S. Miller

| 48 | Chief Financial Officer (July 2012 to present) and Chief Accounting Officer (May 2012 to present) and Executive Director. Certified Public Accountant. Assistant Controller and Assistant Vice-President (2005 to May 2012) of Forest City Ratner, a real estate developer, owner and operator and a wholly-owned subsidiary of a publicly-held company, Forest City Realty Trust, Inc. Mr. Miller’s extensive experience in accounting, finance and the real estate industry is the primary reason, among others, why Mr. Miller was selected to serve on our Board.

| 2017 |

Six

| 16 |

| Nominee | Age | Present Position with the Company; Business Experience During Past Five Years; Other Directorships | Director Since | |||

| Gregory T. Otto | 29 | Independent Director.Maritime Professional (2011 to present) with experiences in commerce, maritime security, and intermodal logistics. Consultant for Paul F. Richardson & Associates (2014 to present), focused on maritime business services. Merchant Marine Deck Officer and Port Operations Coordinator for Maersk Line (2011 to 2014). Lieutenant in the U.S. Naval Reserves (2011 to present), specializing in maritime intelligence with select Active Duty experiences (2017 and 2014). Member of various professional organizations in the international trade, supply chain, and maritime security sectors (2011 to present). Mr. Otto’s experience in logistics, transportation, trade and global markets is the primary reason, among others, why Mr. Otto was selected to serve on our Board.

| 2017 | |||

| Scott L. Robinson | 47 | Independent Director.Managing Director, Oberon Securities (2013 to Present); Clinical Professor of Finance and Director of The REIT Center at New York University (2008 to Present); Managing Partner, Cadence Capital Group (2009 to 2013); Vice President, Citigroup (2006 to 2008); Senior REIT and CMBS analyst (1998 to 2006), Standard & Poor’s. Mr. Robinson’s extensive experience in real estate finance and investment is the primary reason, among others, why Mr. Robinson was selected to serve on our Board. | 2005 |

| 17 |

Class II Directors with Terms Expiring in 2020

| Nominee | Age | Present Position with the Company; Business Experience During Past Five Years; Other Directorships | Director Since | |||

| Brian H. Haimm | 48 | Independent Director. Chief Financial Officer and Chief Operating Officer (2006 to present) of Ascend Capital Group International, LLC, a private equity firm. Mr. Haimm’s extensive experience in accounting, finance and the real estate industry is the primary reason, among others, why Mr. Haimm was selected to serve on our Board.

| 2013 | |||

| Neal Herstik | 59 | Independent Director.Attorney at Law, Gross, Truss & Herstik, PC (1997 to present). Mr. Herstik’s extensive legal experience and experience in the real estate industry is the primary reason, among others, why Mr. Herstik was selected to serve on our Board.

| 2004 | |||

| Matthew I. Hirsch | 58 | Independent Director. Attorney at Law (1985 to present), Law Office of Matthew I. Hirsch; Adjunct Professor of Law, Delaware Law School of Widener University (1993 to present).

For UMH Properties, Inc. (UMH), a related company, Director (2013 to present).

Mr. Hirsch’s experience with real estate transactions, legal issues relating to real estate and the real estate industry is the primary reason, among others, why Mr. Hirsch was selected to serve on our Board.

| 2000 | |||

| Stephen B. Wolgin | 63 | Lead Independent Director. Managing Director of U.S. Real Estate Advisors, Inc. (2000 to present), a real estate advisory services group based in New Jersey. Prior Partner with the Logan Asset Backed Fund, LP (2007 to 2017). Prior affiliations with J.P. Morgan, Odyssey Associates, The Prudential Realty Group, Standard & Poor’s Corporation, and Grubb and Ellis.

For UMH Properties, Inc., a related company, Director (2007 to present).

Mr. Wolgin’s extensive experience as a real estate and finance consultant and experience in the real estate industry are the primary reasons, among others, why Mr. Wolgin was selected to serve on our Board.

| 2003 |

Five of the Company’sour directors are also directors of UMH, a publicly-owned affiliate of the Company, which primarily engages in manufactured housing related real estate transactions.

| 18 |

Other Named Executive Officers of the Company

| Officer | Age | Present Position with the Company; Business Experience During Past Five Years; Other Directorships | Director Since | |||

| Allison Nagelberg | General Counsel (2000 to present).Attorney at Law (1989 to present). Ms. Nagelberg also has a Master of Business Administration in Finance. Ms. Nagelberg is a member of the Rutgers Center for Real Estate Advisory Board (2017 to present).

For UMH Properties, Inc., a related company, General Counsel (2000 to 2013). | N/A |

| 19 |

CORPORATE GOVERNANCE AND BOARD MATTERS

Publicly traded since 1968, Monmouth Real Estate Investment Corporation is one of the oldest publicly traded equity REITs in the world. Our longevity is the direct result of being patient and conservative stewards of capital. The Board’s decision-making process is guided by an appreciation for all that has been built in the past and a focus on continuing to create sustainable long-term value for the CompanyMonmouth and its shareholders for many years to come.

We are committed to maintaining sound corporate governance principles. The Board of Directors periodically updates and approves formal Corporate Governance Guidelines that address the qualifications and responsibilities of directors, director independence, committee structure and responsibilities, and interactions with management, among other matters. The Corporate Governance Guidelines are available on the Company’sour website atwww.mreic.reit.Together with theour charter and bylaws of the Company and the charters of the Board’s committees, the Corporate Governance Guidelines provide the framework for the governance of the Company.

“Good Corporate Governance”

The goal of good corporate governance practices areis fundamentally to ensure that the Company iswe are maximizing shareholder value. As highlighted throughout this Proxy Statement, the Company haswe have adopted numerous good corporate governance policies and procedures. We believe that the quality of any company’s corporate governance practices cannot properly be measured with a “one size fits all” approach. A fair analysis of the effectiveness of a company’s corporate governance should appropriately take into account long-term economic performance and total shareholder return. This is particularlyespecially true for a company that operates within the real estate industry, andindustry. Real estate is thereforea cyclical asset class with average cycles measuring seven to ten years in length. Therefore, in order to be most effectively governed and managed, with a focus on building long-term value.value is essential. We believe that it is essential that dividends be factored into evaluating a REIT’s economic performance. Our dividend has proven to be very reliable because our industrial properties are predominantly subject to long-term net leases to investment-grade tenants or their subsidiaries. On October 2, 2017, our Board of Directors approved a 6.3% increase in our quarterly common stock dividend, raising it to $0.17 per share from $0.16 per share, representing an annualized dividend rate of $0.68 per share. The 6.3% dividend increase marks our second dividend increase in three years, totaling 13% in dividend increases. We are proud to report that we have maintained or increased our dividend for 26 consecutive years. We are one of the few REITs that maintained our dividend throughout the Global Financial Crisis. We are also one of the few REITs that is paying out a higher per share dividend today than prior to the Global Financial Crisis.

The Company, duringDuring the 10-year period ended December 31, 2016,2017, we have delivered itsto our shareholders a total return of approximately 257%323% and outperformed both the S&P 500 by a wide margin of over 2.5 times and the MSCI US REIT Index by a wide margin of over 43 times.

| 20 |

Source: S&P Global Market Intelligence

Substantial Insider Ownership: Management’s Interests are Aligned with Shareholder Interests

The aggregate stock ownership of Companyour Directors and Executive Officers represents more than 5%4.6% of our Common Shares as of the Company’s Common Shares,end of fiscal 2017, and currently represents the third largest block of shareholders behind two institutional investors and helps align our management’s interests with our shareholders’ interests.

Board Leadership Structure and Role in Risk Oversight

Since the Company’sour inception in 1968 through April 2013, the positions of Chief Executive Officer and Chairman of the Board of Directors were combined. For more than forty years, both positions were held by Eugene W. Landy. Effective April 9, 2013, as part of the Board’s succession planning strategy, Michael P. Landy was elected as the Company’sour President and Chief Executive Officer. Mr. Michael P. Landy, who has been with the Company since 2001 and served as the Company’sa director since 2007 and our Chief Operating Officer since 2011, continues to serve as a member of the Company’sour Board of Directors. Mr. Eugene W. Landy continues to serve as Chairman of the Board of Directors. The Board of Directors has selected a Lead Independent Director, Stephen B. Wolgin, to preside at executive sessions of the non-management directors. The Board reviews the structure of the Board and Company leadership as part of the succession planning process. At present, our Board believes that this structure is appropriate and that it facilitates independent oversight of management.

The Board of Directors oversees the Company’sour enterprise-wide approach to the major risks facing the CompanyMonmouth and oversees the Company’sour policies for assessing and managing its exposure to risk. The Board periodically reviews these risks and the Company’sour risk management processes. The Board also considers risk in evaluating the Company’sour strategy. The Board’s responsibilities include reviewing the Company’sour practices with respect to risk assessment and risk management and reviewing contingent liabilities and risks that may be material to the Company.Monmouth. The Audit Committee reviews the Company’sour financial and compliance risks and major legislative and regulatory developments which could materially impact the Company.Monmouth. The Compensation Committee oversees management’s assessment of whether the Company’sour compensation structure, policies and programs create risks that are reasonably likely to have a material adverse effect on the Company.Monmouth.

| 21 |

Board Independence

The Company’sOur Corporate Governance Guidelines include specific Director Independence Standardsdirector independence standards that comply with applicable rules of the SEC and the listing standards of the NYSE. The Board requires that at least a majority of its directors satisfy this definition of independence. The Board of Directors has considered business and other relationships between the CompanyMonmouth and each of its directors, including information provided to the CompanyMonmouth by the directors. Based upon its review, the Board of Directors has determined that allseven of its directors other than Ms. Anna T. Chew and Messrs. Daniel D. Cronheim, Eugene W. Landy, Michael P. Landy, and Samuel A. Landy, are independent, consistent with the Corporate Governance Guidelines. The seven independent directors are Catherine B. Elflein, Brian H. Haimm, Neal Herstik, Matthew I. Hirsch, Gregory T. Otto, Scott L. Robinson and Stephen B. Wolgin. The Corporate Governance Guidelines, which incorporate the NYSE Director Independence Standards,NYSE’s director independence standards, are available at the Company’sour website located atwww.mreic.reitand are available in print upon request.

Committees of the Board of Directors and Meeting Attendance

The Board of Directors had four meetings during the last fiscal year. Noyear and each of the directors attended 100% of the meetings. Our policy is that no director attendedshould attend fewer than 75% of the meetings of the Board of Directors and of meetings of the committees on which he or she served. The Company doesWe do not have a policy concerning directors’ attendance at the Annual Meeting of Shareholders. Three directors attended the Company’s 2016our 2017 Annual Meeting of Shareholders.

The Company hasWe have a standing Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee of the Board of Directors. Each of these committees is composed exclusively of independent directors.

| Name | Age as of record date | Director Since (Calendar year) | Audit Committee | Compensation Committee | Nominating Committee | |||||

| Anna T. Chew | 58 | 2007 | ||||||||

| Daniel D. Cronheim | 62 | 1989 | ||||||||

| Catherine B. Elflein | 56 | 2007 |  | |||||||

| Brian H. Haimm | 47 | 2013 |  |  | ||||||

| Neal Herstik | 58 | 2004 |  | |||||||

| Matthew I. Hirsch | 57 | 2000 |  |  |  | |||||

Eugene W. Landy Chairman of the Board | 83 | 1968 | ||||||||

Michael P. Landy Chief Executive Officer | 55 | 2007 | ||||||||

| Samuel A. Landy | 56 | 1989 | ||||||||

| Scott L. Robinson | 46 | 2005 |  | |||||||

Stephen B. Wolgin Lead Independent Director | 62 | 2003 |  |  |  | |||||

Chair | Member |

| Name | Age as of record date | Director Since (Calendar year) | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | |||||

| Daniel D. Cronheim | 63 | 1989 | ||||||||

| Catherine B. Elflein | 57 | 2007 |  | |||||||

| Brian H. Haimm | 48 | 2013 |  |  | ||||||

| Neal Herstik | 59 | 2004 | ||||||||

| Matthew I. Hirsch | 58 | 2000 |  |  |  | |||||

Eugene W. Landy Chairman of the Board | 84 | 1968 | ||||||||

Michael P. Landy Chief Executive Officer | 56 | 2007 | ||||||||

| Samuel A. Landy | 57 | 1989 | ||||||||

Kevin S. Miller Chief Financial & Accounting Officer | 48 | 2017 | ||||||||

| Gregory T. Otto | 29 | 2017 | ||||||||

| Scott L. Robinson | 47 | 2005 |  | |||||||

Stephen B. Wolgin Lead Independent Director | 63 | 2003 |  |  |  | |||||

Chair | Member |

Audit Committee

The Audit Committee’s responsibilities include reviewing and overseeing financial reporting, policies and procedures and internal controls, retaining the independent registered public accounting firm, approving the audit fees, and monitoring the qualifications, independence and performance of the Company’sour independent registered public accounting firm. It also oversees the internal audit function, legal and regulatory compliance, establishing procedures for complaints received regarding the Company’sour accounting, internal accounting controls and auditing matters. In addition, the Audit Committee prepares the Audit Committee Report, which is included in the Company’sour annual proxy statements. The Audit Committee had four meetings during the fiscal year ended September 30, 2016,2017, including an executive session with the independent auditors, in which management did not attend. The Audit Committee operates under the Audit Committee Charter which is available on the Company’sour website atwww.mreic.reit.

| 22 |

The current members of the Company’sour Audit Committee are Catherine B. Elflein, Brian H. Haimm (who serves as Chairman of the Audit Committee), Matthew I. Hirsch, Scott L. Robinson, and Stephen B. Wolgin. The Board has determined that the members of the Audit Committee are “independent” as defined by the rules of the SEC and the listing standards of the NYSE, and that each of them is able to read and understand fundamental financial statements and is “financially literate” within the meaning of the rules of the NYSE. The Board has also determined that Catherine B. Elflein, Brian H. Haimm, Scott L. Robinson and Stephen B. Wolgin are “audit committee financial experts” within the meaning of the rules of the SEC.

Compensation Committee

The Compensation Committee’s responsibilities include (1) evaluating the Chief Executive Officer’s and other executive officers’Named Executive Officers’ performance in light of the Company’sour goals and objectives and determining the Chief Executive Officer’s and other executive officers’Named Executive Officers’ compensation, which includes base salary and bonus; and (2) administering the Company’sour Amended and Restated 2007 Stock Option and Stock Award Incentive Award Plan as Amended and Restated (the “Original Plan”).(Incentive Award Plan), which was approved at our Annual Meeting held on May 18, 2017. The Compensation Committee had at least one meeting during the fiscal year ended September 30, 2016.2017. The current members of the Compensation Committee are Brian H. Haimm, Matthew I. Hirsch and Stephen B. Wolgin (who serves as the Chairman of the Compensation Committee). The Board has determined that the members of the Compensation Committee are “independent” as defined by the rules of the SEC and the listing standards of the NYSE. The Compensation Committee operates under the Compensation Committee Charter which can be found at the Company’sour website atwww.mreic.reit.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee identifies, considers and recommends candidates to serve as members of the Board and makes recommendations regarding the structure and composition of the Board of Directors and Committees. The Nominating and Corporate Governance Committee had at least one meeting during the fiscal year ended September 30, 2016.2017. The current members of the Nominating and Corporate Governance Committee are Neal Herstik, Matthew I. Hirsch (who serves as the Chairman of the Nominating and Corporate Governance Committee), and Stephen B. Wolgin. The Board of Directors has determined that each member of the Nominating and Corporate Governance Committee is “independent” as defined by the rules of the SEC and the listing standards of the NYSE. The Nominating and Corporate Governance Committee operates under the Nominating and Corporate Governance Committee Charter which can be found at the Company’sour website atwww.mreic.reit.

The principal function of the Nominating and Corporate Governance Committee is to review and recommend candidates for nomination to the Board of Directors. The Nominating and Corporate Governance Committee will consider for recommendation as nominees appropriate individuals whose names are submitted in writing by a shareholder, and will evaluate them using the same criteria as that used for other candidates. See “Shareholder Communications” below for more information.

The Nominating and Corporate Governance Committee has established a process for identifying and evaluating prospective nominees for director. The Nominating and Corporate Governance Committee will annually assess the qualifications, expertise, performance and willingness to serve of existing directors. If at this time or at any other time during the year the Board of Directors determines a need to add a new director with specific qualifications or to fill a vacancy on the Board, the Chair of the Nominating and Corporate Governance Committee will then initiate the search, seeking input from other directors and senior management, considering nominees previously submitted by shareholders, and, if the Nominating and Corporate Governance Committee deems necessary or appropriate, hiring a search firm. The Nominating and Corporate Governance Committee considers real estate expertise, diversity of background and personal experience in identifying director candidates. An initial slate of candidates satisfying the specific qualifications, if any, and otherwise qualifying for membership on the Board, will then be identified and presented to the Nominating and Corporate Governance Committee by the Committee Chairman. The Nominating and Corporate Governance Committee will then prioritize the candidates and determine if the Nominating and Corporate Governance Committee members, other directors or senior management have relationships with the preferred candidates and can initiate contact with the candidate. To the extent feasible, all of the members of the Nominating and Corporate Governance Committee, the President and Chief Executive Officer and Chairman of the Board will interview the prospective candidate(s). Evaluations and recommendations of the interviewers are submitted to the Nominating and Corporate Governance Committee for final evaluation. The Nominating and Corporate Governance Committee will then meet to consider such recommendations and to select the final candidate(s) to recommend to the Board of Directors as nominees. The Nominating and Corporate Governance Committee will evaluate all potential nominees for director, including nominees recommended by a shareholder, on the same basis.

To date, there are no third parties being compensated for identifying and evaluating candidates.

Independent Director Meetings

The Company’sOur independent directors, as defined under the listing standards of the NYSE, have established a policy to meet separately from the other directors in a regularly scheduled executive session at least annually, and at such additional times as they may be deemed appropriate by the Company’s independent directors.deem appropriate. Any independent director may call an executive session of independent directors at any time. The independent directors had at least one meeting during the fiscal year ended September 30, 2016.2017. The Board of Directors has selected a Lead Independent Director, Stephen B. Wolgin, to preside at executive sessions of the independent directors.

Shareholder Communications

Monmouth believesWe believe that effective corporate governance should include regular constructive discussions with our shareholders. We have a proactive engagement process that encourages feedback from our shareholders. This feedback helps shape our governance practices. Shareholders and other interested parties who desire to contact the Company’sour Board of Directors may do so by writing to: Board of Directors, c/o Secretary, Monmouth Real Estate Investment Corporation, 3499 Route 9 North, Suite 3-D, Freehold, NJ 07728. Communications received will be distributed to the Chairperson of the appropriate committee of the Board depending on the facts and circumstances outlined in the communication. Shareholders and other interested parties also may have direct communications solely to theour independent directors of the Company by addressing such communications to the independent directors, c/o Secretary, at the address set forth above. In addition, the Board of Directors maintains special procedures for the receipt, retention and treatment of complaints that may be received by the Companyus regarding accounting, internal accounting controls or auditing matters and for the submission by our employees, of the Company, on a confidential and anonymous basis, of concerns regarding questionable accounting or auditing matters. Such communications may be made by writing to the Audit Committee of the Board of Directors, c/o Secretary, at the address set forth above. Any such communication marked “Confidential” will be forwarded by the Secretary, unopened, to the Chairman of the Audit Committee.

Code of Business Conduct and Ethics

The Company hasWe have adopted a Code of Business Conduct and Ethics, which applies to all directors, officers, and our employees, of the Company, including itsour principal executive officer and our principal financial officer. This code is posted on our website atwww.mreic.reit. During fiscal 20162017 and through the date of this Proxy Statement, no violations of the Code of Business Conduct and Ethics were reported nor were any waivers granted.

Anti-Hedging Policy

The Company considersWe consider it inappropriate for any director, officer or employee to enter into speculative transactions in Company securities. Such transactions, while allowing the holder to own Companyour securities without the full risks and rewards of ownership, potentially separate the holder’sholders’ interests from those of other Company shareholders. Therefore, the Company prohibitswe prohibit the purchase or sale of puts, calls, options or other derivative securities based on the Company’sour securities by directors, officers or employees. Our policy also prohibits hedging or monetization transactions, such as forward sale contracts, in which the holder continues to own the underlying Company security without all the risks or rewards of ownership. The Anti-Hedging Policy is posted on our website atwww.mreic.reit.

| 24 |

As of the date of this Proxy Statement, to the best of the Company’sour knowledge, no director, officer or employee has entered into speculative transactions in Company securities.

CEO Stock Ownership RequirementClawback Policy

In October 2017, the Compensation Committee adopted a clawback policy that provides that, in the event of a material restatement of our financial results, other than a restatement caused by a change in applicable accounting rules or interpretations, the Committee will review the performance-based compensation of our Named Executive Officers, as defined in our Proxy Statement from year to year, for the three years prior to such material restatement. If the Committee determines that the amount of any performance-based compensation actually paid or awarded to a Named Executive Officer (Awarded Compensation) would have been lower if it had been calculated based on such restated financial statements (Actual Compensation) and that such executive officer engaged in actual fraud or willful unlawful misconduct that materially contributed to the need for the restatement, then the Committee may direct Monmouth to recoup the after-tax portion of the difference between the Awarded Compensation and the Actual Compensation for the Named Executive Officers. The Committee has absolute discretion to administer and interpret this policy in Monmouth’s best interests.

Stock Ownership Guidelines for CEO, NEOs and Directors, and Stock Holding Guidelines

In order to encourage our directors and Named Executive Officers (NEO) to retain investments in Monmouth and help further align their interests with the interests of our stockholders, the Committee has adopted stock ownership guidelines applicable to our directors, our Chief Executive Officer and our other Named Executive Officers, recommending that they hold the following amounts of our stock:

| Position | Stock Ownership Guideline |

| Chief Executive Officer | 6x base salary |

| Other NEOs | 2x base salary |

| Director | 3x annual cash fee |

| All NEOs | 50% of net shares received upon exercise/vesting of equity awards (24 month holding period) |

For purposes of determining compliance with these ownership guidelines (other than the Company is required to own Common Shares having a value equal to at least six times his or her base salary. The Chief Executive Officer serving, as of September 17, 2015, will have until September 17, 2020, to meetholding period for vested equity compensation), the minimum ownership requirements. Any subsequent Chief Executive Officer elected after the adoption of these requirements will have five years from the time he or she is elected to meet the minimum ownership requirements. The Chief Executive Officer’s stock ownership levels will be evaluated by or at the direction of the Company’s Chief Financial Officer in connection with the preparation of the Company’s Annual Report on Form 10-K or the Company’s proxy statement each year. The value of each director’s or officer’s stock holdings will be calculated based on the closing price of a Common Shareshare of the Companyour common stock on the last trading day of theour fiscal year, ending priorwhich was $16.19 on September 29, 2017. Shares owned by a director or officer include: shares owned outright by the director or officer or by his or her immediate family members residing in the same household; shares held in trust or under a similar arrangement for the economic benefit of the director or officer; restricted or unrestricted stock issued as part of the director or officer’s compensation, whether or not vested; shares acquired upon option exercise that the director or executive officer continues to own; and shares held for the annual review. If thedirector or executive officer’s account in a 401(k) or other retirement plan.

Our Chief Executive Officer meets the ownership requirements at the time of the annual review, he or she will be in compliance with these requirements until the next annual review. Changes in the Company’s stock price or changes to base salary will not affect compliance status for the remainder of that year. The Nominating Committee has authority to administer and interpret these requirements.